At Mixta Africa, we go beyond just being a Real Estate company to handling Infrastructural development and providing varying investment options to help you grow your wealth and hedge against inflation.

Commercial paper is a short-term, unsecured debt instrument issued by Mixta typically for the financing of short-term liabilities. The papers are opened to the public from time to time with a minimum of N5m subscription fee and ROI running from 4% to up to 25% depending on market rates at time of sale

You can invest into a Land Banking plan by buying any of our various plots available within the fast-developing Lagos New Town. You can benefit from land banking by acquiring land at current market prices and holding it for potential long-term capital appreciation. Additionally, land banking allows investors to diversify their investment portfolio and hedge against inflation. Our plot sizes start from 350sqm above. You can buy in bulk for further development or as an investment.

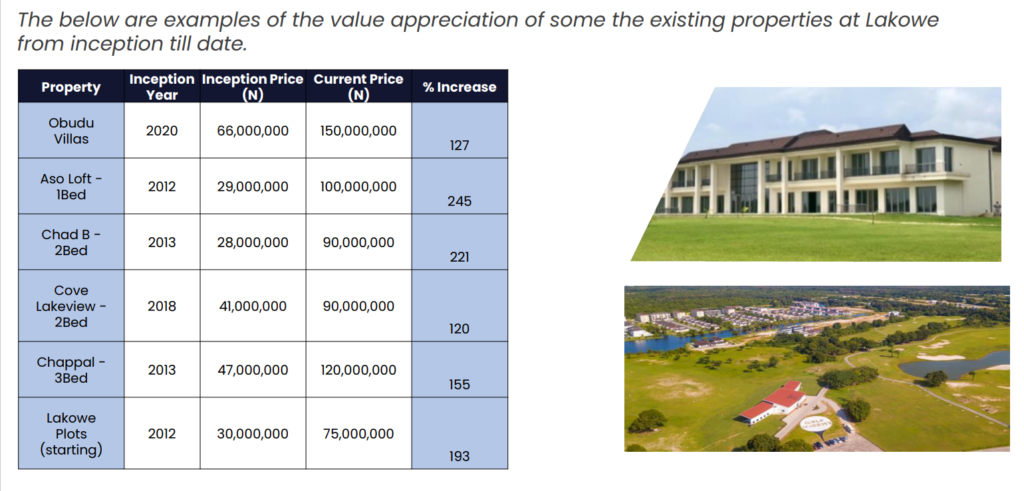

A quick way to make money from any of our homes is through a “Buy to Sell” program where you can simply buy any of our homes off plan and sell upon build in 3 to 4 years. We provide investors with access to vetted properties, market insights, and project management support to execute successful buy to sell strategies and achieve attractive returns on their investments. Majority of our properties have been known to give over 100% ROI upon build.

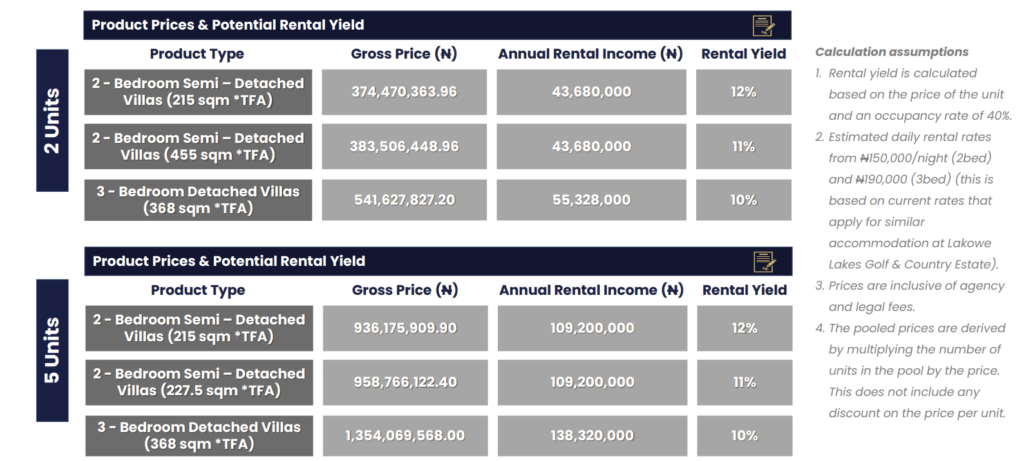

You could also buy any of our properties and put it up for rent either for an annual fee or short let fee. We help with managing a rental pool which helps you get tenants, manages your home for short stays and handles marketing for the short stay clients.

Mixta Africa’s rent-to-own offering provides you as a tenant with a pathway to homeownership and the ability to build equity over a 3-year period. You can pay your annual rent (5% of the cost of the home) for 3 years and by the 4th year, your total rent for the 3 years is deducted from the total cost of the home at that time – reducing your cost of purchase. Not only does give you time to gather funds to purchase, you can also make some extra funds by subletting

Mixta Fracti is a co-ownership or joint ownership investment strategy where two or more individuals (Family/Friends/Colleagues) collectively purchase a property. Each co-owner holds a percentage of ownership in the property, typically proportional to their financial contribution.

Schedule a meeting with any of our designated investment advisors today to determine what option is best suited for you.

Mitchael brings a unique blend of real estate expertise, seamlessly integrated with the scientific acumen of salesmanship.

With over six years of dynamic experience in real estate sales and marketing, Mitchael has assisted his clients in investing over $3m in investment and feedback has been mostly impressive.His passion for real estate, coupled with his diverse skill set, allows him approach sales and marketing challenges with a fresh perspective, driving results and exceeding expectations.

A Regional Sales Lead with over 8 years experience in sales and marketing, her unique selling proposition lies in her ability to drive unprecedented revenue growth and market share expansion. Ezigbo has been able to effectively identify and capitalize on emerging real estate trends, translating them into targeted, impactful sales strategies and amplified customer engagement.

Her career has been characterized by a proven track record of elevating sales teams, marketing initiatives, and fostering enduring client relationships, positioning her as an invaluable asset in driving sustainable business development in real estate sales.

Ben Chiedu is a seasoned professional with a strong foundation in accounting, holding a B.Sc. in the field. With a cumulative career spanning a decade, Ben has spent the last six years specializing in real estate. His expertise lies in providing comprehensive real estate advisory services to both individuals and corporations.

Ben excels in guiding clients through a diverse range of investment opportunities, including first home purchases, investment properties, and strategic portfolio management. With a keen understanding of market dynamics and a commitment to client satisfaction, Ben consistently delivers tailored solutions to meet the unique needs of his clientele.

Subscribe to our newsletter to receive updates from Mixta Africa

8. Kasumu Ekemode Street off Saka Tinubu, Victoria Island, Lagos, Nigeria