As a real estate investor, I understand the critical role of a Contract of Sale in land transactions in Nigeria.

This isn’t some dusty formality; it’s the ironclad agreement that keeps your entire deal on solid ground.

In my experience, a clear, well-drafted contract is essential. It outlines everything from the agreed price to each party’s responsibilities, ensuring everyone knows what’s expected.

I mean why play blindfolded with your investment? Without a proper contract, you’re one wrong turn away from a legal landmine.

Boundary disputes, payment snags, ownership woes – these can all erupt in the absence of a solid agreement.

This clarity is vital for smooth transactions and helps avoid misunderstandings that could lead to disputes or financial loss.

Let’s take a quick look at what this contract entails and how to go about it.

What is a Contract of Sale of Land?

A Contract of Sale of Land in Nigeria is an agreement between two parties in which one party agrees to sell a piece of land, and the other agrees to buy it for a specific price.

In very simple terms, think of it like a promise between a seller and a buyer. The seller promises to give the land to the buyer, and the buyer promises to pay the seller an agreed amount of money.

This contract is important because it lays out all the details about the transaction, such as:

Who is selling and who is buying, what is being sold, how much it costs, the payment details, and the conditions or rules.

Once both parties sign this contract, it becomes a binding agreement, meaning both the seller and the buyer must follow through on their promises.

If either party doesn’t do what they agreed to, the other party can take legal action to enforce the contract or seek compensation for any losses.

This contract is an essential step in ensuring that land sales are conducted fairly and legally in Nigeria.

Key Elements of a Contract of Sale

Let me break down the essential components of a land sale contract in straightforward terms:

- Parties Involved: This section names the seller and buyer, providing their full details. It shows the who’s who in the deal, ensuring everyone knows the key players involved.

- Description of the Property: Here, we detail the land’s specifics – where it’s located, its size, and the plot number. This part paints a picture of the property, so there’s no confusion about what’s being bought or sold.

- Purchase Price and Payment Terms: This spells out the land’s cost and how the buyer plans to pay—be it a lump sum, a deposit followed by installments, or another arrangement. It’s the financial blueprint of the sale, outlining how and when payments should be made.

- Completion Date: This is the deadline by which the ownership of the land is transferred from the seller to the buyer. It’s a crucial date, marking when the buyer officially becomes the new owner.

- Title Information: In this section, we confirm that the seller truly owns the land and has the right to sell it. It includes the legal documents and history of the property to ensure everything’s above board.

- Covenants: These are the promises or agreements made by both parties. For example, the seller might guarantee that the title is free and clear from any claims or liens. This helps the parties make clear commitments to each other to ensure trust in the transaction.

- Dispute Resolution: Sometimes, disagreements happen. This part of the contract decides how disputes, if any, will be resolved, whether through arbitration or court proceedings. It’s like a pre-agreed plan for smoothing out any bumps in the road.

- Signatures and Witnesses: The contract isn’t complete until everyone signs it, often in the presence of witnesses. This makes the agreement official and legally binding, sealing the deal in the eyes of the law.

These components work together to create a clear, enforceable agreement that protects both the buyer and the seller. This ensures that the sale goes smoothly and that everyone’s rights are upheld.

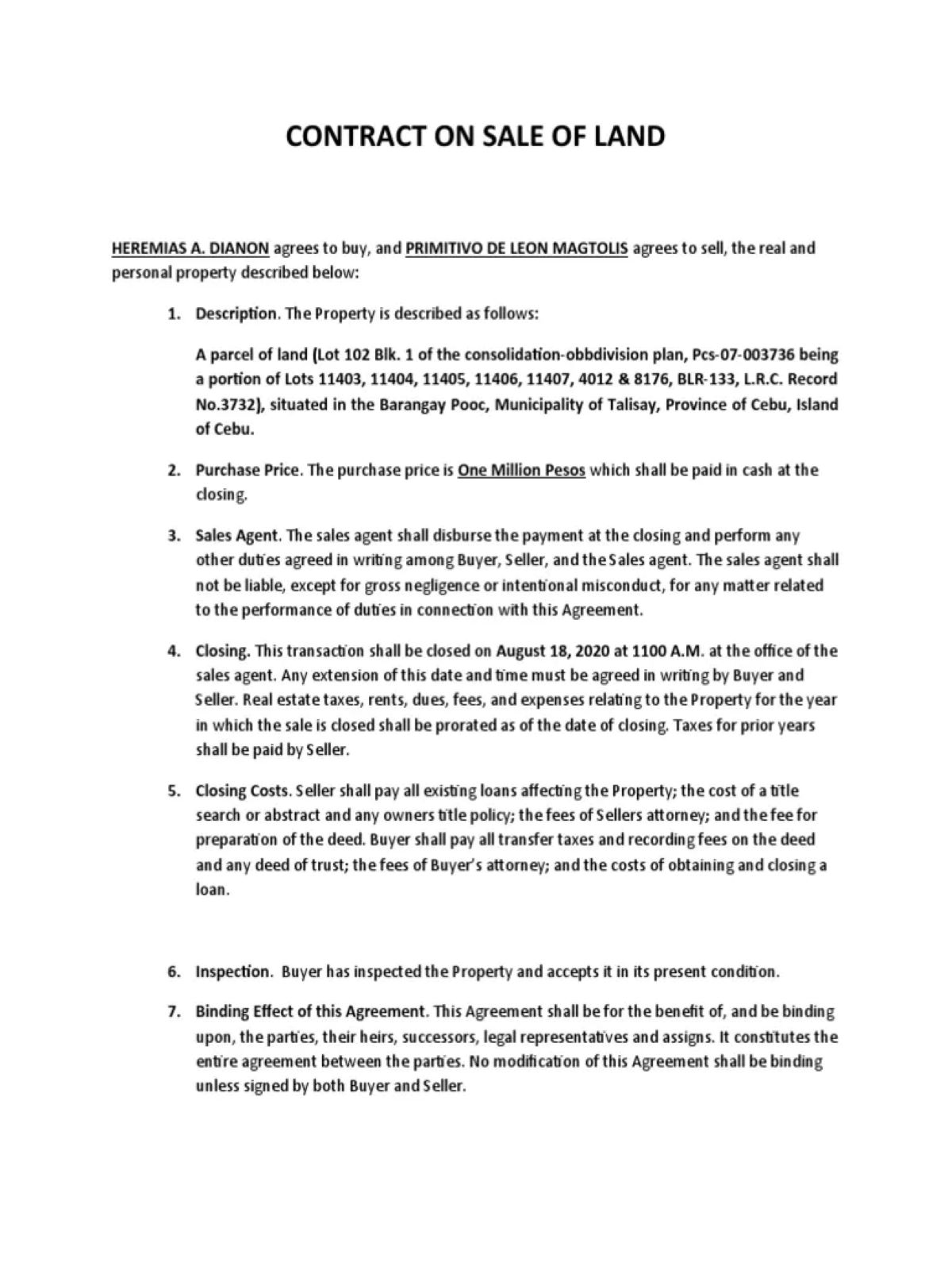

A Sample of Contract of Sale

Looking for Land Investment Opportunities?

If you’re interested in exploring land investment options, a reputable developer like Mixta Africa can be a valuable partner. They can offer a variety of residential and commercial land suited to different budgets and needs.

Mixta Africa has land available in prime locations around Lagos, including estates like Lakowe Lakes Estate.

These locations not only offer potential appreciation but could also be ideal for building your dream home or commercial property.

Additional Considerations

In addition to the contract itself, there are several key aspects to consider when engaging in a land transaction:

1. Due Diligence

Before sealing the deal, it’s crucial to investigate the land and the seller’s title thoroughly. This means checking the property’s history, ensuring there are no disputes or claims against it, and confirming the seller legally owns and has the right to sell the land.

2. Approvals and Certificates

Ensure you obtain all necessary approvals and certificates for the land. This could include zoning approvals, building permits, and environmental clearance. These documents prove that the land can be used for your intended purpose and that all legal requirements have been met.

3. Legal Review

Lastly, having a lawyer review and finalize the contract is crucial. A lawyer can spot issues you might overlook, provide legal advice, and ensure the contract meets all legal standards and protects your interests.

Taking these steps can help secure your investment and avoid future legal problems, making your land transaction smoother and more secure.

Check out my other helpful guides on land in Nigeria:

Land Tenure System in Nigeria: Types & Advantages

Excision of Land: Meaning, Cost, and How To Process It

Land Banking: Meaning and How to Invest for Maximum

Conclusion

Getting a land sale contract right in Nigeria is crucial. This contract lays out everything about the sale, helping avoid confusion and legal issues.

Always include details like who’s buying and selling, property info, how much it costs, and when the sale will be complete.

Also, make sure to check the property’s history and get all necessary legal documents. Having a lawyer look over everything can save a lot of headaches later.

Remember, doing things properly from the start can make buying land much smoother and more secure. All the best with your contract!

Author’s Note: Hi, I’m Joy – a seasoned finance professional based in Lekki, Lagos. I balance a fulfilling career with successful real estate investments in Nigeria. Join me as I share insights on navigating the world of real estate investments in Nigeria. Let’s find your dream home and unlock financial success together!