Ever dreamt of owning a home in Nigeria, but worried about paperwork getting in the way?

Well, having proper house documentation is very crucial in Nigeria.

For me, ensuring that all property papers are in order means peace of mind and security. It’s like having a reliable map; it guides you through legal, financial, and administrative terrains.

Without these documents, you could face numerous challenges.

Imagine trying to prove you own your dream property – a stressful nightmare!

So, avoid the headaches, and let’s dive into 5 important house documents in Nigeria and how you can get them.

5 Important House Documents to Have To Own a Home in Nigeria:

1. Certificate of Occupancy (CofO):

In Nigeria, the Certificate of Occupancy (CofO) serves as the primary legal document evidencing land ownership, crucial for any real estate transaction or development.

It’s issued by state governments, specifically by the authority of the state’s governor, and it confirms that the occupant holds rights to the property in question.

The CofO is essential for safeguarding your investment in real estate, providing legal proof that can prevent disputes, facilitating transactions like sales or leases, and serving as collateral for loans.

Owning a property with a CofO in a strategic location like Mixta Africa’s Lagos New Town can be especially beneficial.

This is a developing area with the potential for high returns on investment, similar to what Lekki experienced a few decades ago.

Imagine having a property with a CofO in this prime location – it could be a life-changing investment!

To obtain a CofO in Lagos, you need to:

- Initiate the Application: Start at the Surveyor General’s office to get a Land Information Certificate, costing around ₦10,000 to ₦12,000. This certificate confirms essential land details.

- Purchase Application Form: Purchase and submit the Private Certificate of Occupancy Application Form alongside required documents such as land purchase receipts, tax clearance certificates, and passport photographs.

- Submit Application and Wait: After submission, a publication is made to invite objections to the application, with a standard objection period of 21 days.

- Site Inspection and Report: Following the objection period, the Land Use Allocation Committee conducts a site inspection and prepares a report essential for the CofO issuance.

- Governor’s Approval: The application goes through several administrative levels before being executed by the Governor of Lagos State.

After the Governor’s execution, the CofO undergoes stamp duty and registration before it is finally issued to you.

In Lagos, obtaining a CofO for a plot of land might cost upwards of N400,000, excluding other taxes and fees.

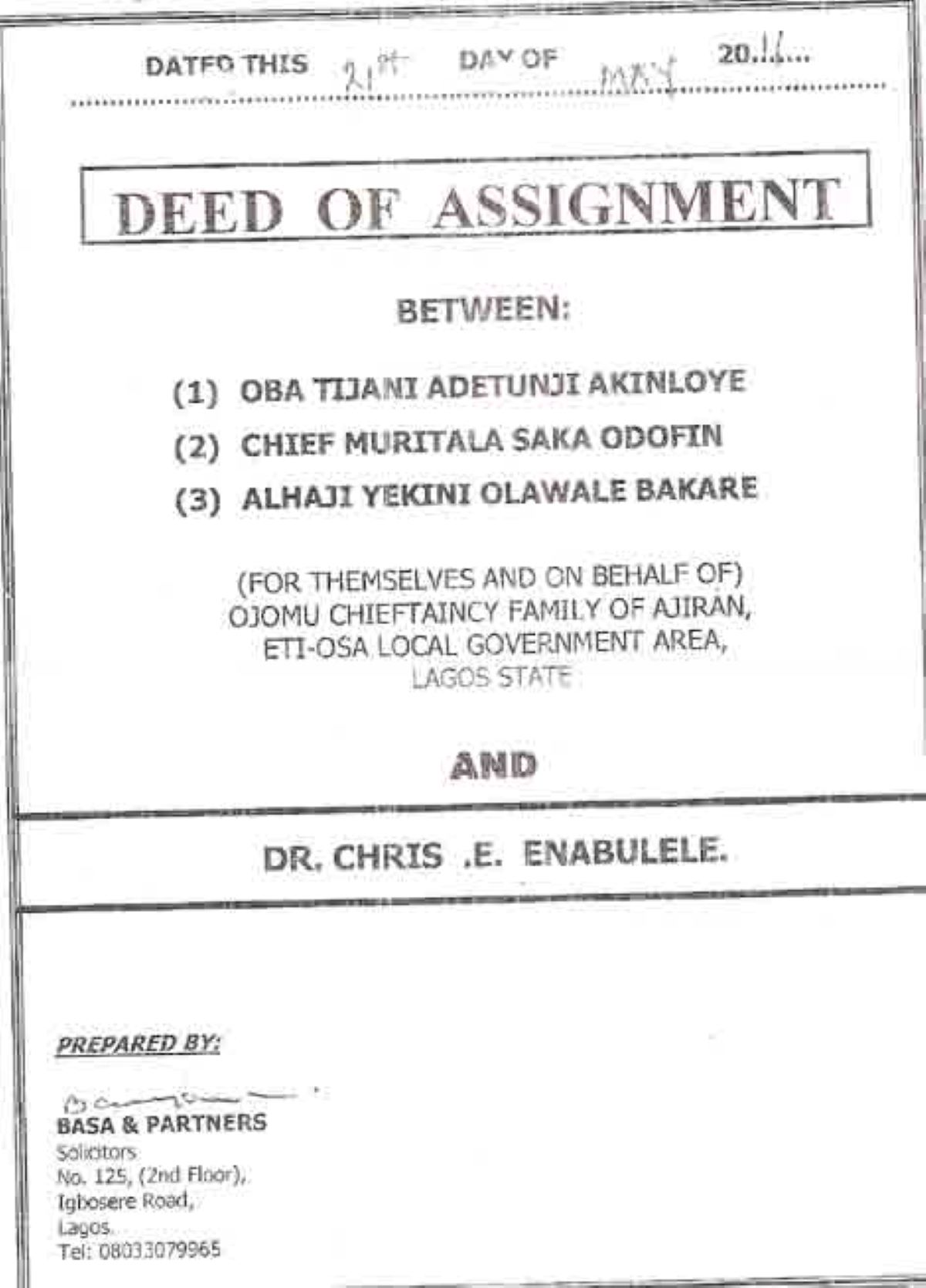

2. Deed of Assignment:

The Deed of Assignment is essentially a legal agreement that transfers the ownership of a property from the seller to the buyer.

It’s a critical piece in the puzzle of property transactions, serving as the main record that shows the property has a new owner.

A Deed of Assignment contains important details such as the description of the property, the names and addresses of the seller and buyer, the agreed selling price, and the date of the property transfer.

It outlines the terms and conditions of the sale, ensuring that both parties understand their rights and obligations.

Given its importance in the property transfer process, it’s crucial to have this document reviewed by a lawyer.

A legal expert can ensure that the Deed of Assignment is properly executed, free from errors or omissions, and that it accurately reflects the agreement between the seller and buyer.

This review can prevent potential legal issues down the line, safeguarding your investment and giving you peace of mind in your property transactions.

3. Registered Survey Plan:

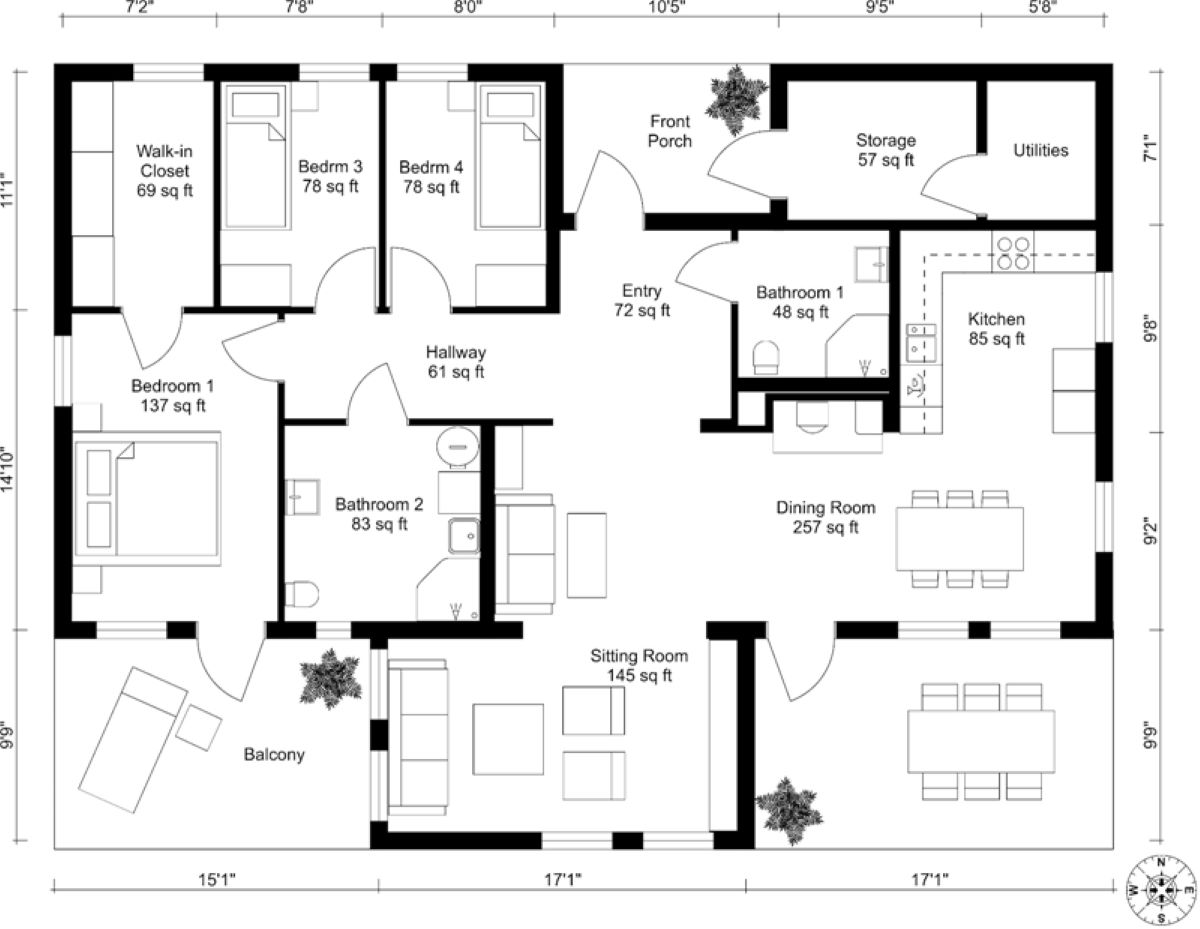

A Registered Survey Plan in Nigeria is a crucial document that outlines the exact boundaries and location of a piece of land.

A licensed surveyor prepares it and provides an accurate measurement and detailed description of the property.

This document is vital for confirming the dimensions and exact location of your property, ensuring there are no disputes regarding its boundaries.

The benefits of having a current Registered Survey Plan include legal recognition of the land’s boundaries, aiding in property transactions, and helping to prevent land disputes.

It also ensures that the property is not located within government-acquisition areas or designated for other uses that could affect ownership rights.

Here’s how you can get a registered survey plan in Nigeria:

- Hire a Licensed Surveyor: Engage a surveyor who is registered with the Nigeria Institution of Surveyors.

- Conduct the Survey: The surveyor measures the land and creates the survey plan, detailing the boundaries and features of the property.

- Submit the Survey for Registration: The completed survey plan must be submitted to the state’s Office of the Surveyor-General for registration.

- Verification and Approval: The Surveyor-General’s office verifies the details and, upon satisfaction, approves and registers the survey plan.

- Collection of Registered Survey Plan: Once registered, you can collect the final document, which now serves as a legal representation of your property’s boundaries and size.

Consult a professional in the real estate or legal field to help you navigate the process of obtaining and registering a survey plan.

They can also assist in ensuring that the survey plan meets all the required legal and regulatory standards.

Looking to invest in a property in Lagos? Consider exploring communities like Marula Park, offering apartments with various ownership options.

With a 12-monthly payment plan, you can acquire a Marula Park apartment via DUO by Mixta Africa rent-to-own scheme or the Mixta Flex mortgage scheme!

4. Approved Building Plans:

Approved Building Plans are official documents that provide detailed specifications on the design, layout, and structure of a building project.

These plans must be reviewed and sanctioned by the relevant local government or urban planning authority before construction can commence.

The approval ensures that the building conforms to zoning laws, building codes, and safety standards.

Having Approved Building Plans is important, especially for future renovations or maintenance.

These plans serve as a blueprint that guides any changes or repairs to the structure, ensuring that modifications are consistent with the original design and meet current building regulations.

To obtain Approved Building Plans, you can follow these general steps:

- Consult a Qualified Architect or Engineer: Have them draw up detailed plans of your proposed building.

- Submit the Plans for Approval: Take the detailed plans to the local urban planning authority or government agency responsible for building regulations in your area.

- Review and Compliance Check: The authority will review the plans to ensure they comply with local zoning laws, building codes, and safety standards.

- Collect Your Building Plans: Once the plans meet all the requirements, they will be approved, and you can collect the official Approved Building Plans.

These plans may be obtained from the seller if the property already exists and modifications are planned, or directly from the governmental planning authority for new constructions.

- Development Levy Payment Receipts:

Development levies are fees charged by local governments for the infrastructure and services provided in an area, especially concerning new property developments or significant improvements to existing structures.

These levies help fund public services like roads, parks, schools, and utilities, ensuring that the development contributes to the community’s overall well-being.

Having receipts for these payments is crucial as they serve as proof that you have contributed to the community’s infrastructure and complied with local regulations.

These receipts are important for record-keeping, future property transactions, or when seeking approval for further development or modifications to your property.

To obtain copies of Development Levy Payment Receipts, you can:

- Check with the Seller: If you’ve purchased a property, the previous owner should provide these receipts as part of the transaction documentation.

- Visit the Local Government Office: If you are the original payer of the levy, or if the seller does not have the receipts, you can obtain copies from the local government or municipal office where the payments were made.

Maintaining a record of these payments and securing receipts is part of responsible property management and is beneficial for both legal compliance and future administrative needs.

NOTE: It’s crucial to keep these documents safe and organized. Storing them in a fireproof safe, securing digital copies, or using a bank-safe deposit box can protect them from damage or loss.

You might want to check out my guide on Proof of Land Ownership in Nigeria

Conclusion

Each house document mentioned plays a vital role in Nigeria’s property management and ownership.

Having these documents readily available and in good order helps you meet legal requirements, safeguard your investment, and ensure peace of mind in your real estate dealings.

Author’s Note: Hi, I’m Joy – a seasoned finance professional based in Lekki, Lagos. I balance a fulfilling career with successful real estate investments in Nigeria.

Join me as I share insights on navigating the world of real estate investments in Nigeria. Let’s find your dream home and unlock financial success together!